At ThinkLab, our passion exists at the intersection of specification and design, where we use research to improve communications between designers and manufacturers. Over the past 15 weeks, we have been tracking the impact of the COVID-19 pandemic on the design industry—looking at metrics like bid activity, employment, and project continuation. These results have been shared freely with anyone who participates in our weekly Industry Impact Survey—which we invite you to take!

While the feedback to this type of data was positive, the response was crystal clear: “This is great, but we want MORE.” As a result, our most recent deep dive was published as a feature in Metropolis Magazine, where we highlighted 11 weeks and 1,697 data points of metrics. We started collecting data in March, saw the effects of PPP loans in weeks 4 to 8, and saw reopening start in weeks 9 to 11—all of which was reflected in this report.

So, as a continuation of our data share, today we include an update on those statistics, as well as new insights as we continue to collect data from the industry.

What vertical markets are moving?

Economically, the major impacts to the U.S. economy as a result of COVID began in March. Since then, here's what we’ve seen in terms of vertical market shifts:

- Workplace: On hold—lots of discussions about right-sizing post-COVID (especially in tech sector)

- Retail, oil, airlines, consulting, hospitality (specifically restaurants), creative, and financial sector projects: Mostly on hold

- Emergency healthcare: Increasing, while nonurgent is on hold or canceled for now

- Residential: Appears to be moving forward or even increasing pending owner financial situations

- Multifamily: On hold or continuing pending date of construction start

- Civil and government: Appear to be moving forward (mostly)

- K12 education: Continuing with projects previously funded, while many suggest changes may be to come

- Higher education: Slowing; concerns about reallocation of funds amid decreased revenue. (Note: This was exceptionally heavy in the write-ins beginning early July.)

For more data on vertical market expansion, inquire about our Hot Market Growth report, ThinkLab’s exclusive study of specific metrics behind vertical, geographical, and product-related growth signals leading into 2020 overlaid with an up-to-date analysis of the impact of COVID-19.

How has COVID impacted the different audiences within the interiors industry?

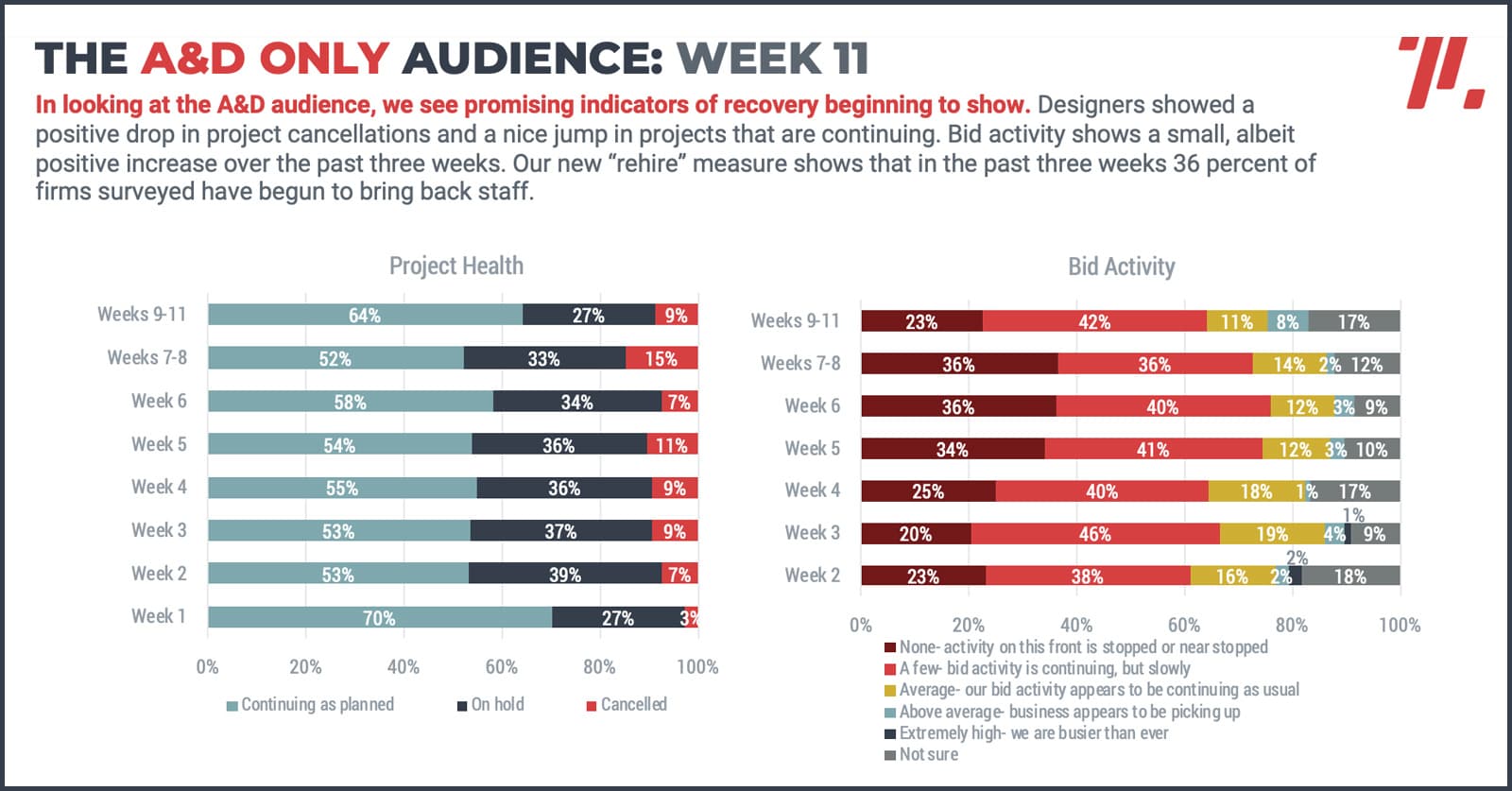

Throughout this study, the proportion of manufacturers saying that bid activity has stopped completely has never reached above 4 percent. Meanwhile, this proportion has never reached below20 percent for A&D firms. This means more pain is likely ahead for manufacturers as that slowed bid activity works its way through the ecosystem. So let’s look a bit deeper at what’s happening with the A&D community in WEEKS 9–11.

Based on the dates of our measure, weeks 9–11 fell late May into early June, when states began to reopen. Weeks 9–11 showed the highest amount of reported restructuring at A&D firms but also the highest amount of “rehiring” as many states began to loosen restrictions (Spoiler alert: In our forthcoming WEEK 15 report out, you’ll see that the negative employment action drops significantly.) We also see continued encouraging metrics in bid activity being “less bad” (because we still can’t call it good) in WEEKS 9–11, and this trend continues through week 15.

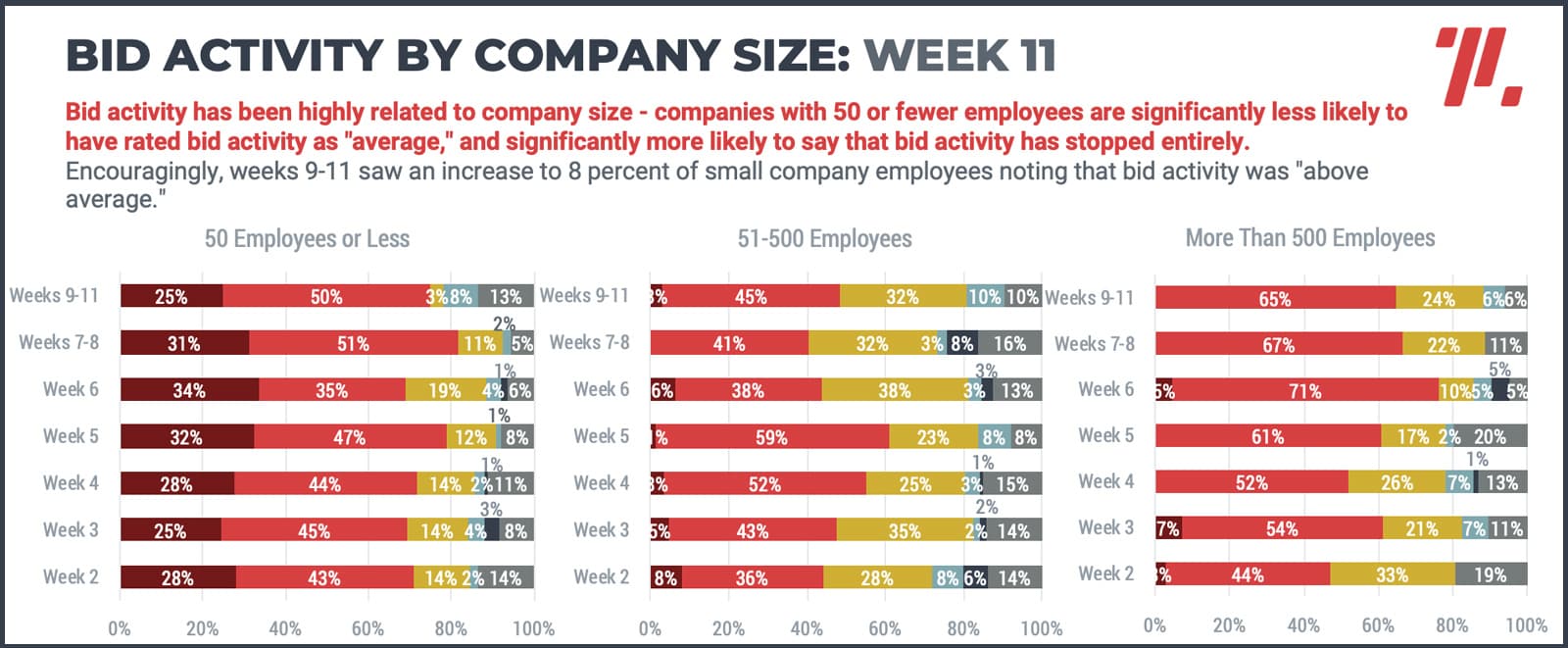

What about the impact by company size?

Companies with 50 or fewer employees reacted faster (or were hit harder) than large companies when it came to pay cuts and furloughs. Additionally, and especially in the early days of measure, small companies had more projects put on hold and experienced a greater decrease in bid activity.

Has the impact shifted between geographic markets?

In general, companies in the eastern part of the U.S. have been more likely to put projects on hold or cancel them altogether; however, weeks 9–11 show promising results of project movement. For example, weeks 9-11 show the most optimism in the eastern part of the U.S. with the highest “continuing” numbers and lowest “canceling” numbers.

If this research has taught us anything, it’s the power of data. We believe today more than ever that data can drive your important business decisions. Receive subscription-based access to this level of data and more through the ThinkLab’s Insider Program.

And to continue to receive this data, we invite you to take our industry impact survey every week, so you can get results like this delivered straight to your inbox, including access to our next deep dive, scheduled for release in August.

Amanda Schneider is President of ThinkLab, the research division of SANDOW. At ThinkLab, we combine SANDOWMedia’s incredible reach to the architecture and design community through brands like Interior Design Media, Metropolis, and Material Bank with proven market research techniques to uncover relevant trends and opportunities for the design industry. Join in to explore what’s next at thinklab.design/join-in.

Photograph: Courtesy of Carvart